The Role of Data Analytics in Risk Management

Discover how data analytics is revolutionising risk management in various industries.

Understanding the Importance of Risk Management

Risk management is a crucial aspect of any business, especially in the financial services sector. It involves identifying potential risks, assessing their impact, and implementing strategies to mitigate them. Without proper risk management, organisations are exposed to various uncertainties that can lead to financial losses or reputational damage.

Data analytics plays a vital role in risk management by providing insights into potential risks and helping organisations make informed decisions. By analysing large volumes of data, companies can identify patterns, trends, and anomalies that may indicate potential risks. This allows them to take proactive measures to prevent or mitigate the impact of these risks.

Furthermore, data analytics enables organisations to assess the effectiveness of their risk management strategies. By analysing historical data, companies can evaluate the outcomes of previous risk management initiatives and identify areas for improvement. This helps organisations refine their risk management processes and enhance their overall risk mitigation capabilities.

The Evolution of Data Analytics in Risk Management

Data analytics has undergone significant evolution in the field of risk management. In the past, risk management relied on manual processes and subjective assessments. However, with the advent of advanced analytics techniques and technologies, organisations can now leverage the power of data to make more accurate and data-driven risk management decisions.

Initially, risk management focused on basic analytics, such as descriptive analytics, which provided a retrospective view of past events. However, as technology advanced, organisations started using predictive analytics to forecast future risks and prescribe preventive measures. Today, risk management has evolved to include prescriptive analytics, which not only predicts risks but also suggests optimal risk mitigation strategies.

The evolution of data analytics in risk management has also been driven by the increasing availability of data. With the proliferation of digital technologies, organisations now have access to vast amounts of data from various sources, such as transactional records, social media, and sensor data. This data can be leveraged to gain deeper insights into risks and develop more effective risk management strategies.

Benefits of Data Analytics in Risk Management

Data analytics offers several benefits in the field of risk management. Firstly, it enables organisations to identify and assess risks more accurately. By analysing large volumes of data, organizations can uncover hidden patterns and correlations that may not be apparent through traditional risk assessment methods. This allows them to identify emerging risks and take timely action to mitigate them.

Secondly, data analytics helps organisations optimise their risk management strategies. By analysing historical data, organisations can identify the most effective risk mitigation techniques and prioritise resources accordingly. This ensures that resources are allocated to the areas of highest risk, leading to more efficient risk management processes.

Thirdly, data analytics enhances the speed and agility of risk management. By automating data collection, analysis, and reporting processes, organisations can quickly identify and respond to risks in real-time. This enables them to make faster and more informed decisions, reducing the potential impact of risks on the business.

Lastly, data analytics enables organisations to gain a competitive edge in risk management. By leveraging advanced analytics techniques, organisations can develop predictive models that anticipate risks before they occur. This proactive approach allows them to stay ahead of the competition and make strategic decisions to mitigate risks effectively.

Challenges and Limitations of Data Analytics in Risk Management

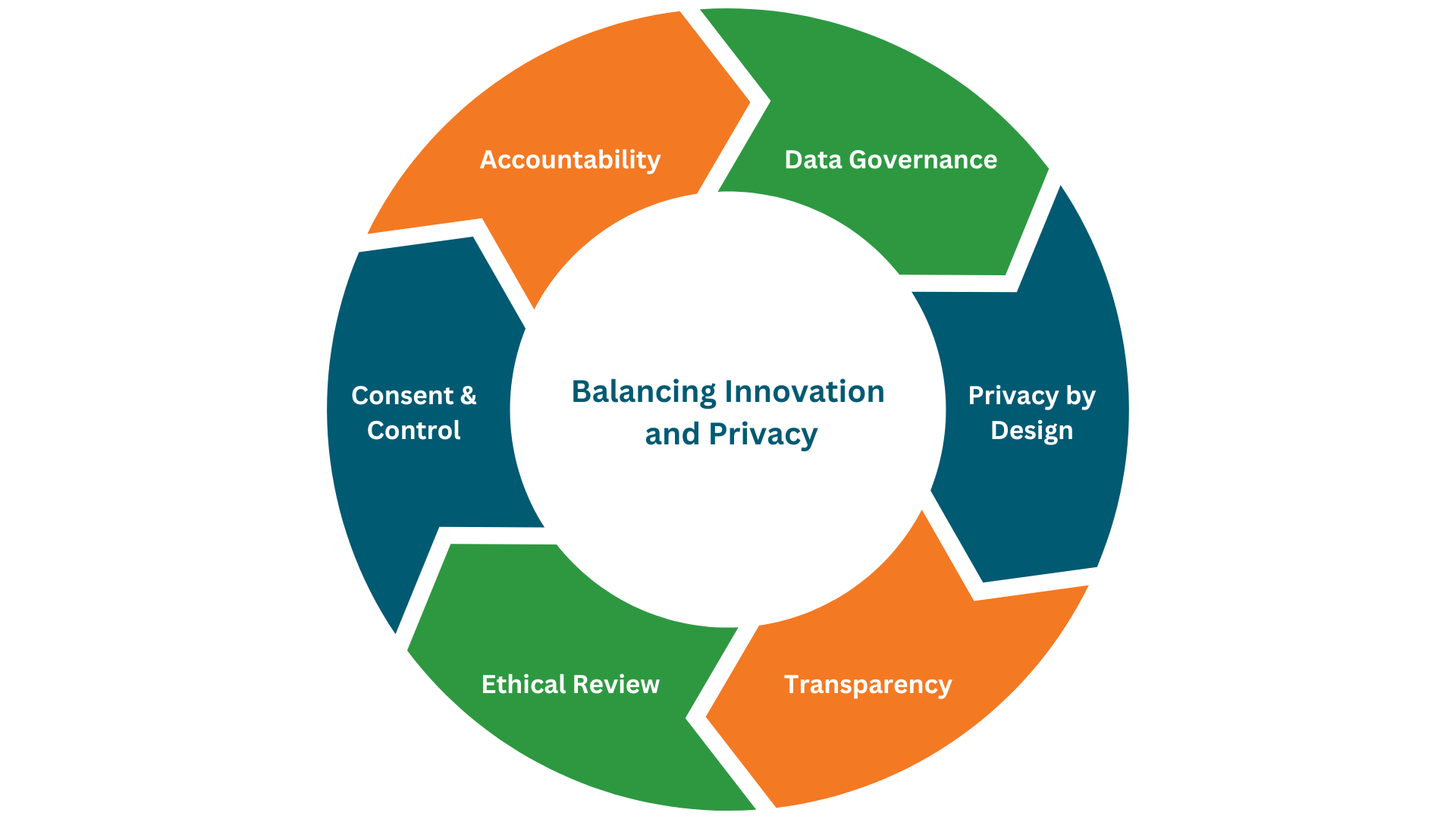

While data analytics offers numerous benefits in risk management, it also comes with its own set of challenges and limitations. Firstly, data quality and reliability can be a significant challenge. Organisations need to ensure that the data used for risk analysis is accurate, complete, and up-to-date. This requires robust data governance frameworks and data quality management processes.

Secondly, data privacy and security concerns can hinder the effective use of data analytics in risk management. Organisations need to comply with strict regulations and protect sensitive customer information. This can sometimes limit the availability and accessibility of data for risk analysis purposes.

Another challenge is the complexity of data analytics techniques and technologies. Organisations need to invest in skilled data analysts and advanced analytics tools to effectively analyse and interpret the vast amounts of data available. Additionally, continuous training and upskilling are required to keep up with the rapidly evolving field of data analytics.

Lastly, data analytics may not always provide accurate predictions or insights. There is always a degree of uncertainty associated with risk analysis, and data analytics models are not foolproof. Organisations need to acknowledge these limitations and use data analytics as one of the tools in their risk management toolkit, rather than relying solely on it.

Future Trends and Innovations in Data Analytics for Risk Management

The field of data analytics for risk management is continuously evolving, and several future trends and innovations can be anticipated. Firstly, the use of artificial intelligence (AI) and machine learning (ML) algorithms is expected to increase. These technologies can analyse vast amounts of data and identify complex patterns, leading to more accurate risk predictions and smarter risk management strategies.

Secondly, the integration of real-time data sources and advanced data visualisation techniques will become more prevalent. Real-time data feeds from various sources, such as social media and IoT devices, can provide valuable insights into emerging risks. Coupled with dynamic data visualisation tools, organisations can quickly identify and respond to risks in real-time.

Another future trend is the use of big data analytics for risk management. With the increasing volume, velocity, and variety of data, organisations can leverage big data analytics to gain deeper insights into risks. By analysing data from diverse sources, organisations can uncover hidden patterns and correlations that were previously unknown, leading to more accurate risk assessments.

Lastly, the field of data analytics for risk management is likely to witness advancements in explainable AI. As AI algorithms become more complex, there is a growing need for transparency and interpretability. Explainable AI techniques aim to provide insights into how AI models make predictions, enabling organisations to understand and trust the results generated by these models.

Next steps

Contact Ometis today to understand how we can help introduce data management, governance, quality and analytics strategies and solutions.

Book a meeting using the link below and let us help you get more value from your data.

Most businesses know their analytics could perform better.

Our independent audit identifies what's holding your platform back and shows you how to fix it. Find out what's slowing your analytics down and how to fix it.

Comments